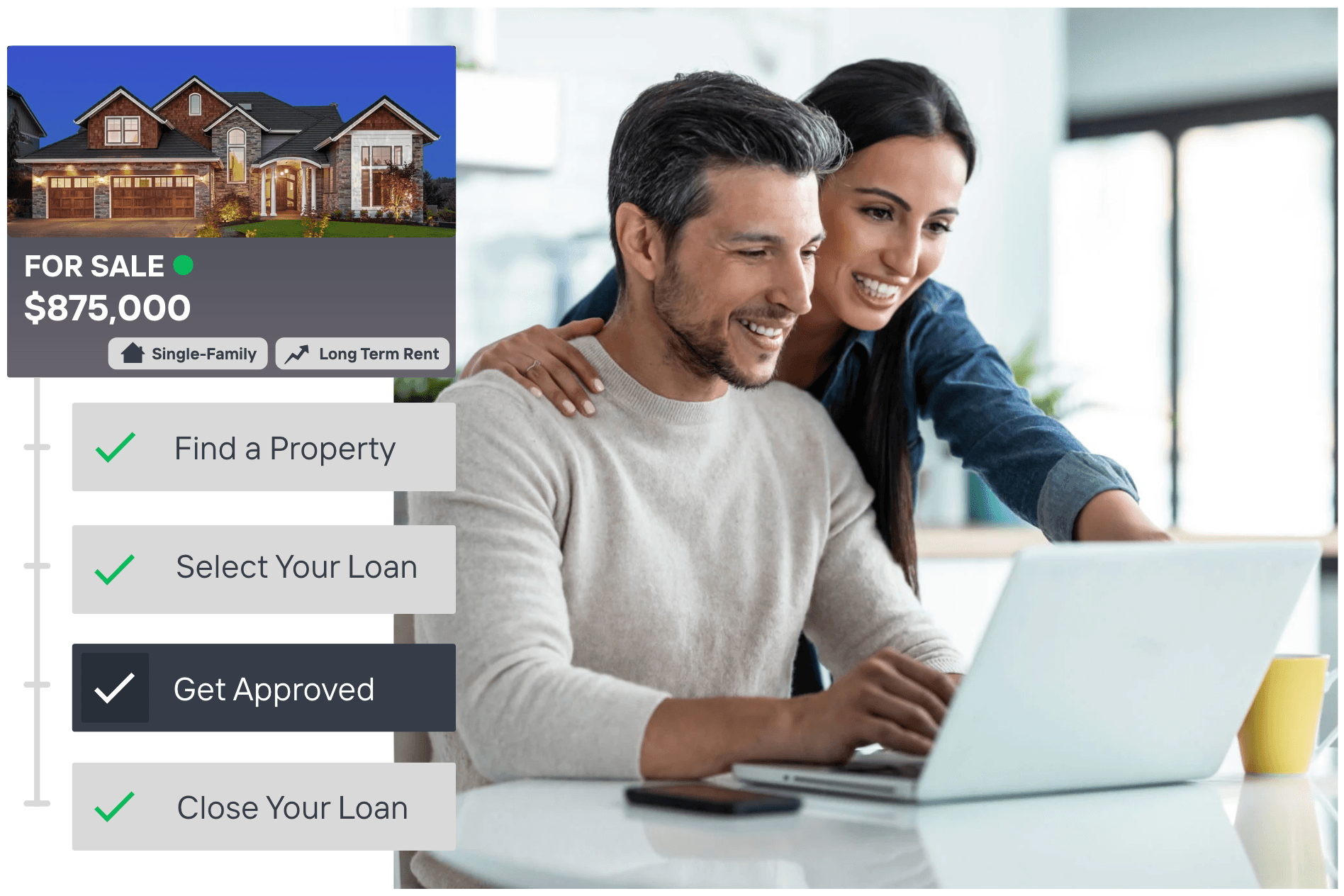

One Partner. Every Scenario.

Proven Capital Solutions for Real Estate Investors

Nationwide real estate lending made simple for new and pro investors.

Rental – DSCR Loan

Purchase or refinance 1–4 unit properties effortlessly with our rental loan, designed to boost cash flow so you can pocket more.

More Info

30-Year DSCR

Cash-Out Refinance

Rate and Term Refinance

Portfolio Loan

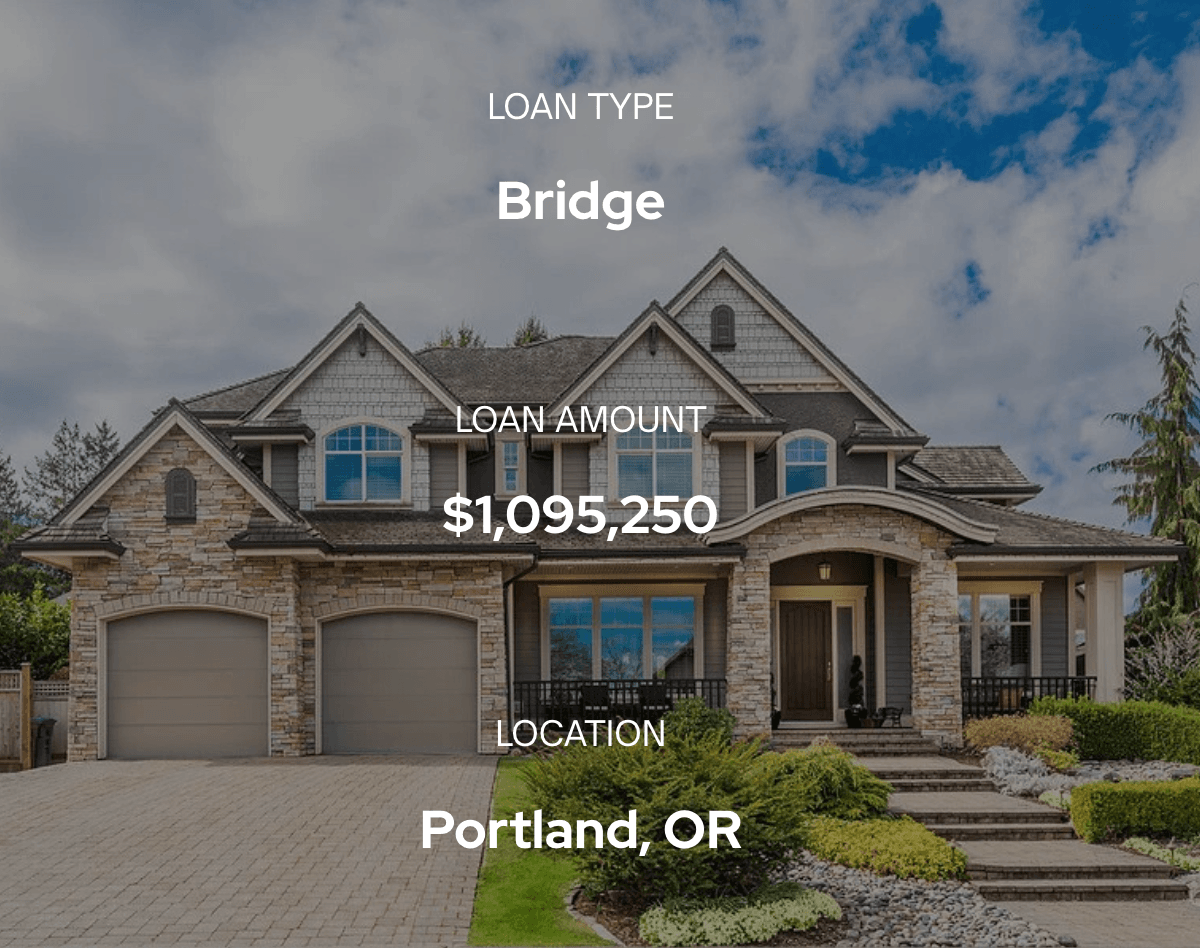

Bridge Loan

Need quick, short-term funding? Our Bridge Loan makes it easy to buy, refinance, or renovate your investment property.

More Info

Purchase

Refinance

Rehab Financing

Commercial Bridge Loan

Fix and Flip Loan

Move fast and flip smarter. Our Fix & Flip financing gives you the capital to buy, renovate, and exit profitably—without delays.

More Info

FixNFlip

Fix to Rent

Bridge Plus

Rehab Financing

New Construction Loan

Financing for new builds and major renovations, tailored to fit projects from the blueprint phase to final development.

More Info

Ground-Up Construction

Build-to-Rent

Bridge Plus

Heavy Rehab Financing

Get Your Funding

Don’t let financing slow you down. Get pre-approved for your next investment today!